The dollars and cents of life after college!

I recently had the pleasure of sitting down with a high-school senior trying to determine the right fit for college. His dad reached out for advice as he was grappling with the overwhelming financial burden on his first-born son. The cost of a four-year education is somewhere between $60K – $120K depending on the college. Of course, his son was leaning towards the more expensive out-of-state option.

To help facilitate the discussion, we started with the end goal in mind.

- What kind of career do you expect upon graduation?

- Where do you want to live?

- What kind of lifestyle do you want?

- Do you want to own a home or rent an apartment? Live alone or with roommates?

- What are your saving goals?

The reality is not many high school students or even college students have really thought about what it costs to live on their own. They may have grand ambitions of a nice luxury car, an extravagant vacation once or twice a year and a downtown apartment, but they don’t really know how that translates in dollars and cents. And based on their salary expectations, what can they really afford?

There is so much readily available information now about salary expectations post-graduation, but I was still surprised at the inflated expectation some have. For planning purposes, you should never expect to be any better than average unless you’re attending a prestigious college. The national average salary for a college graduate is about $50K per year. If they are going in a specific field, say Computer Science, that average might be slightly higher like $65K. If you’re going into psychology or social working, you might plan to make even less than the average college graduate.

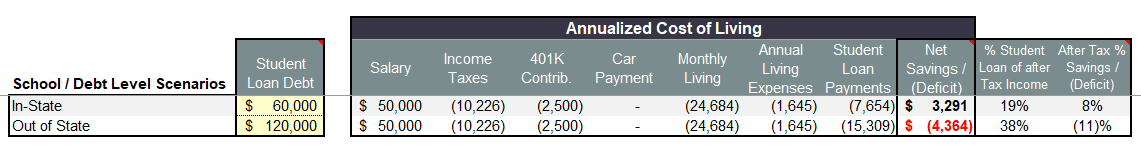

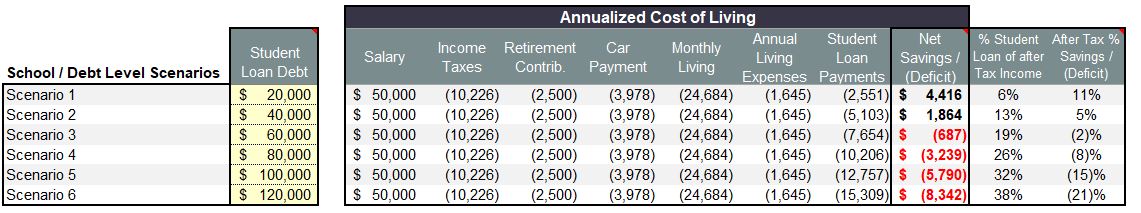

I laid out in excel a model that demonstrates how the different college options would affect his quality of living post-graduation. For an in-state tuition at $60K, a starting salary of $50,000 could mean a semi-frugal living standard and paying about 19% of after tax income to student loan repayment. The fancy out of state tuition at a whopping $120K with the same cost of living assumptions is 38% of the after-tax income towards student loan debt. It would also mean relying on credit card debt or his parents to cover the annual cost of living deficit of $(4,400) per year.

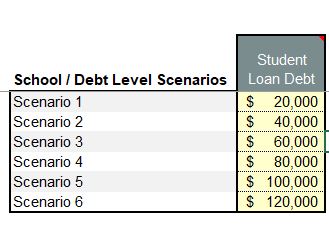

It is a real eye opener and not really a surprise to many who have lived with crippling student loan debt. Seeing that it might have had an impact in the financial direction of this young man, I’ve adapted the financial model to allow for six different student loan debt scenarios. You can also input your specific personal cost of living assumptions.

Here’s how to use the tool:

Step 1: Download the Mrs Mula’s Cost of Living Calculator.

Step 2: Update the scenarios in the top left section. Instead of “Scenario 1”, you could change this to a specific school name or using different living options that might impact your annual college living costs. Then input the expected total debt that you would accumulate at the end of four years. If you have received scholarships, then you could include those assumptions to reduce the total student loan debt.

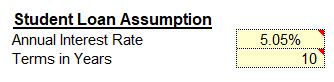

Step 3: Complete the student loan payment assumptions based on interest rates and the expected term. Right now, the average Federal Student Loan rate is 5.05% and average term of 10 years. I have used those as the default, but if you are seeking private loans you can update accordingly.

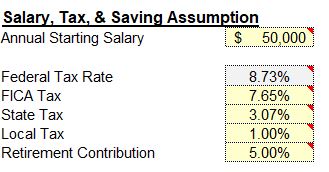

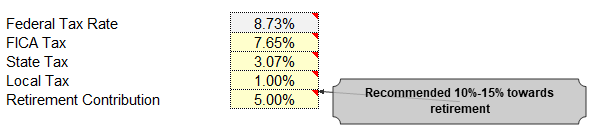

Step 4: Input your expected salary, tax and saving assumptions. I’ve personally pre-populated with the average salary for a college graduate of $50K per year. I’ve included a calculator to automatically calculate income taxes using the 2019 federal tax rate and using the standard deduction assumptions. It also includes a section for the FICA tax rate and a spot to input your expected state & local taxes. You should be able to look up the state & local taxes easily online.

Then input the percentage of your salary you want to contribute to your retirement plan (i.e. 401K or IRA). I’ve defaulted to 5%. From my personal experience, it’s hard to start investing early. I would recommend saving 10-15% of your salary out of the gate, but it may be very hard with the rising cost of student loan debt.

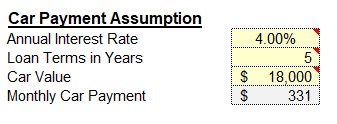

Step 5: Identify if you are planning to finance a car. If you plan to purchase a vehicle, there is a car payment calculated to identify the monthly payment. If you already have a car or don’t need transportation, then you can input zero in the car value to reflect to annual car payment.

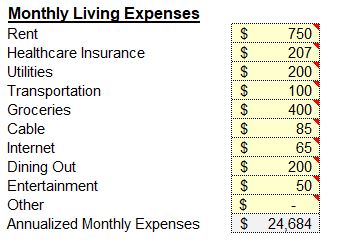

Step 6: Identify your monthly living expenses. This is where you can really research or find ways to live a little more frugally. For example, average rent in my area is about $1,100 per month. But assuming you don’t need the nicest apartment out of college you might be able to get $750. If you have a roommate, maybe it’s even less. I’ve input average prices based on my research and experience, but these can be tailored based on your specific lifestyle assumptions.

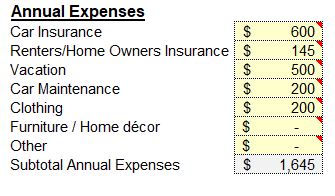

Step 6: Identify your annual living expenses, such as car insurance, home-owners insurance, vacation assumptions, car maintenance, etc.

Step 7: Review the cost of living summary. The net savings / (deficit) column will give you an idea if you can afford the level of student loan debt. If the net savings is positive, this is extra money you’ll build in your bank account as additional security. You can use this to start building an emergency fund or possibly to put towards a down payment on a home.

If the net savings is negative, you are spending more than your income level affords. You will need to rely on additional debt (i.e. credit cards) or support from your parents in order to fund your lifestyle. You are also not getting a good return on your education investment – as your expected salary after graduation doesn’t cover your expected living expenses.

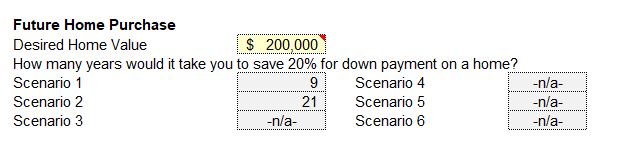

Step 8: Review the future home purchase assumption at the bottom. If you are interested in eventually buying a home, the model will give you an idea how many years it would take to save enough money to put towards a down payment on a home based on the difference scenarios.

Anywhere you see a comment box or that little red marker in the upper right hand corner of a cell, I’ve included a comment. This might be an explanation of the field or a recommendation on how to populate the field.

Lastly, if you run into any problems or have a suggestion on how to modify the template for a specific need, leave me a comment. Looking forward to hearing from anyone who uses the tool and how it might impact their college decisions!

For more insights on how to minimize your student loan debt, check out my article on Growing Student Loan Debt.