Net Worth Tracker

I’ve uploaded my personal net worth excel tracker! I will load in two phases, phase 1 will include just the net worth tracker and phase 2 combines both the net worth tracker and budget tracker.

As a corporate finance junkie, I am an avid excel user, so for me this is the most practical way to track our finances. I also like this approach rather that trusting other online or personal finance software as I own my data, it’s free, and excel gives me all the flexibility to add notes or break down and summarize data at my own whim.

For now, let’s take a look at how to populate the net worth tracker.

First, download the Mrs. Mula Net Worth excel template.

Change the name in cell A2 and re-save the file to your computer. We call our’s the Mula Financial Empire – since the Hubs is a big Star Wars fan.

Start by populating a list of all your personal financial accounts, assets, and debts in column A under “Account Name”. These could be your individual accounts or if you’re doing this with your partner, it could be a consolidated list of your mutual assets and liabilities. If you have a lot of accounts, be descriptive enough so you can easily identify them the next time but not too descriptive in case someone were to gain access to your file and have all your financial data.

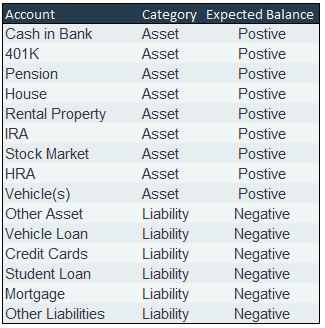

For each account, select the corresponding drop down in column B under the header “Account Type”. The drop down’s are currently configured to show the following types of accounts. For example if you have a savings account at Bank XYZ, I would use the account category “Cash in Bank”. This would be grouped later with all other banking accounts. Additionally, the expected account sign should be positive – with the exception of course if you are overdrawn on your personal savings account and had a negative balance.

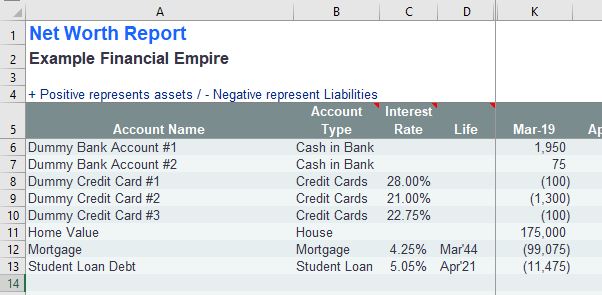

In addition, I like to include details on my outstanding debt information about the interest rates and the life of the obligation. For example, your credit card interest rate might be 22% while your mortgage rate is 4.25% with a life of 30 years. This will help you visually see you debts and how they compare in terms of interest to help you prioritize paying down on the higher interest bearing accounts.

Here is an example of what it should look like if you started populating the template as of March 2019.

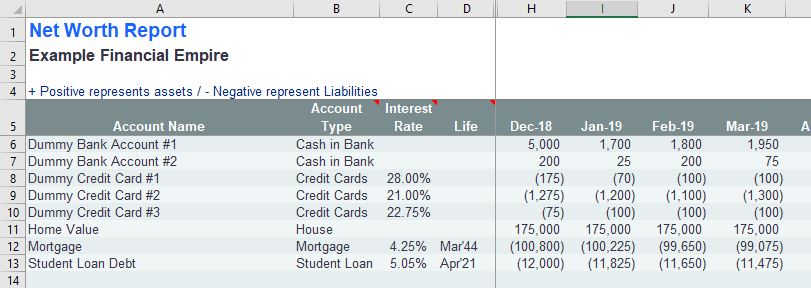

I would also recommend, if you have the information available, going back and populating your historical information from end of prior year if you can replicate all the information. If not, no big deal because you’ll start to build up your financial history over time if you continue to update this monthly.

If you were able to go back and load historical information, it might look something like this:

As you populate the template, don’t forget to include home values, car values and any other personal property assets that might contribute to your overall net worth. For guidelines on what you should and shouldn’t include in your tracker and how to assign a value to certain assets, read the Fundamentals of Net Worth.

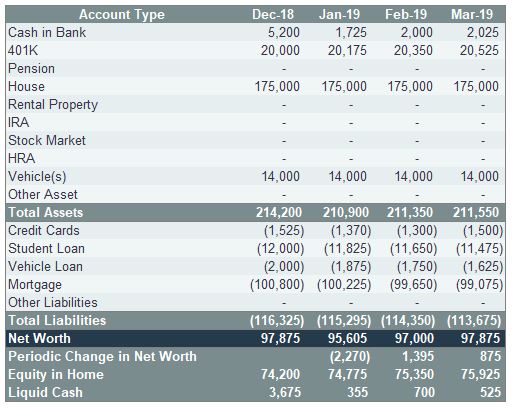

Once you have all the accounts listed, assign account types and a value to each account, you’ll see your net worth summary populated in the table below. Your net worth is a total of everything you own less everything you owe. The report is designed to group certain categories of accounts, such as credit cards, so you can get a complete view of all of your credit card debt without having to add up various cards.

A net worth greater than zero, means you own more than you owe. A bigger positive net worth is always better, but how big it should be is all relative to your own personal financial goals.

A net worth less than zero, means you owe more than you own.

You’ll also notice a few calculations below the Net Worth summary.

First is the Periodic Change in Net Worth, which is calculating the change in your net worth month to month. A negative change means you’ve reduced your net worth – which is a result of spending more than you make for a given period or possibly the result of a dip in the market value of some of your investments. If you have too many month’s in a row of negative changes in net worth, you should really consider starting a budget to take a closer look at where you’re losing money.

Second is the Equity in Home, which is a calculation of the value of your home if you were able to sell if today at a fair market value less the outstanding principle on your home mortgage.

Lastly, there is a calculation for Liquid Cash. These are assets that are currently or can be converted to cash quickly. This includes your cash on hand, bank savings & checking, and money market accounts. I also subtract our credit card balances, as we are in the habit of paying off the balance in full every month. Liquid cash is an important metric as this is a good indicator of how long you could afford to live in the event you lost your job. If you take your liquid cash divided by your monthly expenses you would get the number of months of financial security. As a general rule, the Mula’s recommend having six month’s of minimum expenses as liquid cash.

I have also included a section below the net worth report to track financial memo items. These could be items such as credit scores, stock options, or employer matched portion of 401(k) retirement savings that have not vested. I like to include them on the tracker as memo items if I do not currently have the rights to these assets or if they are only used as financial indicators.

Don’t forget to save the changes that you made to your excel workbook.

The most important part, no matter what the numbers say about your net worth, is you can continue to improve on it month to month. By setting a baseline, you are more informed about your personal financial situation than before. You also have all the details at your fingertips to start making choices that increase your net worth over time.

Don’t forget to set a reminder on your calendar once a month to update your personal net worth tracker. The numbers won’t lie… this is an unbiased way to get grounded in the realities of your financial situation. If most of your account information is available online or you’re organized, it shouldn’t take you more than 20 minutes once a month to update.

Let me know how it goes an if you need any support modifying the template for your own financial needs.