$10 towards retirement

Can you save just ten dollars per week for retirement? That’s $520 per year to put aside for your financial peace of mind. It might not seem like a lot of money in relation to what you may need to retire, but that is all it would take to retire better than the average American if you started investing in your twenties. That’s the brilliant effect of compounding interest!

I did a little math. If someone contributed $10 per week and invested in an index fund following the S&P 500 back in 1979, they would have contributed a total of $20,800 over 40 years. That investment would be worth $119,750 at the end of 2018 using real historical market data.

Compare that to the average American investing in Vanguard’s retirement plan who only has $103,866. You’d have $15K more than average. The median retiree aged 65+ has just under $65,000 saved according to Vanguard’s How America Saves 2018 annual report. In my example by putting away just $10 per week you could have 85% more than half of current retiree’s if you start investing early.

Ideas to save $10 per week

One easy way to save additional $10 per week is to clip coupons on items you already buy. I personally get those somewhat obnoxious Clipper magazines in the mail periodically. It just takes 30 seconds to flip through and see if there’s anything you already buy (just don’t forget to use them!). If you are a Target shopper like me, I have the free Target Cartwheel app downloaded, just click to add items to your wallet and simply scan at checkout. If you have something specific in mind, you can also check out the Krazy Coupon Lady or do directly to the manufacturer’s website.

You can also save by signing up for free Amazon price trackers. This is a convenient way to save money on items you purchase on Amazon, just by setting up a price watch. Check out more details on Mula Approved Amazon Hacks.

Reduce the cost of your monthly bills, such as shopping for better car insurance or finding a cheaper Alternatives to Cable.

Sell the stuff you already own but aren’t using on eBay or Facebook Marketplace. I’ve personally sold everything from furniture to a set of used dish towels. Facebook Marketplace is surprisingly easy and convenient since you can arrange pickup right at your door. You can also see the buyer’s profile and see how other people have rated them. It’s also a good excuse to eliminate the clutter around your house.

If you’re an hourly employee, sign up for overtime or ask to take a shift for someone who needs a little extra time off.

Being April 15th, if you’re eligible for an income tax refund, you can allocate that unplanned inflow of cash to your retirement account.

Or simple allocate your next pay raise directly towards retirement. If you’re lucky enough to get the 2% to cover inflation – you won’t even miss it if you immediately contribute it to savings.

How to start investing?

If you do not have any retirement plan, a good place to start is to see what is offered by your employer. This might be 401(k) or 401(b) plans. If your employer has a program, you should also ask if they offer any match incentive. If you contribute 1% of your salary they may match you 100% or 50% of every dollar you put in up to a certain threshold. For example if you put in $40 per month and they match 50%, they will contribute $20 on your behalf. This is essentially free money – so if they do offer any contribution match you should immediately start putting the amount up to their contribution limit!

If your work does not offer any retirement plan, then you should think about a Traditional IRA or Roth IRA. There are different tax implications for each – so do your homework. Shop reputable providers, my company offers Fidelity for their 401(k) plans for example and we use Vanguard for our personal investing. You can also check your local bank to see what retirement options they offer.

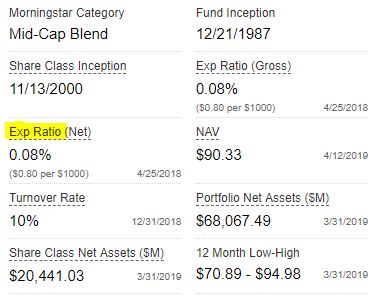

The Mula’s personally invest primarily in index funds – they are low cost and diversify your risk across a portfolio of stocks or bonds. You can use an index fund that tracks the S&P 500 for example or Vanguard offers their total stock index fund. It’s important to keep the costs of your funds as low as possible to get the best return over time! Check out the expense ratio listed for each investment choice before you decide where to invest.

One important reminder – investing in retirement should be in it for the long game. Don’t get dissuaded by short term market volatility. Over the long haul – keeping your money invested even in the downturns is important. The market will typically recover in 1-2 years (i.e. even after the big recession in 2008) and you don’t want to miss out on the upside!

Whatever investment tool you choose, set it up so it auto deducts from your paycheck – this way you can set your retirement savings on auto-pilot!

What if you didn’t start investing in your twenties?

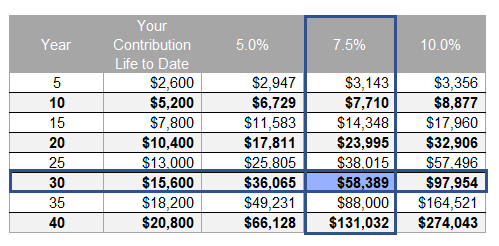

If you didn’t invest in your 20’s, you can still make a big dent in retirement by starting today. If you’re like me and in your early thirties, you have about 30 years before retirement. By saving $520 annually assuming an annual return of 7.5%, you would have $58K by retirement!

The below chart shows how much you could save assuming 5%, 7.5%, and 10% based on the number of years invested. You’ll notice that the longer you keep the investment in, the bigger impact of compounding interest. I used 7.5% since that aligns to historical market performance of the S&P 500. If you are more conservative investor making 5%, then you might only have $36K after 30 years.

What if I can investment more?

If you’re fortunate enough to have ability to contribute more than $10 per week, you should absolutely take advantage of compounding interest. Let’s say you can contribute about $2K per year, that would be about $40 per week or 4 times more that the example above.

With 30 years to retire, if you multiplied a factor of four by the expected ending balance of $58K (assuming a 7.5% return), you’d have $232K. Every additional dollar you can contribute over time can really add up!

Please share what’s working for you in the comments below and as always like and share us on Facebook, Twitter and all of your other favorite social media platforms!